20+ paycheck calculator okc

Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Simply enter their federal and state W-4 information as.

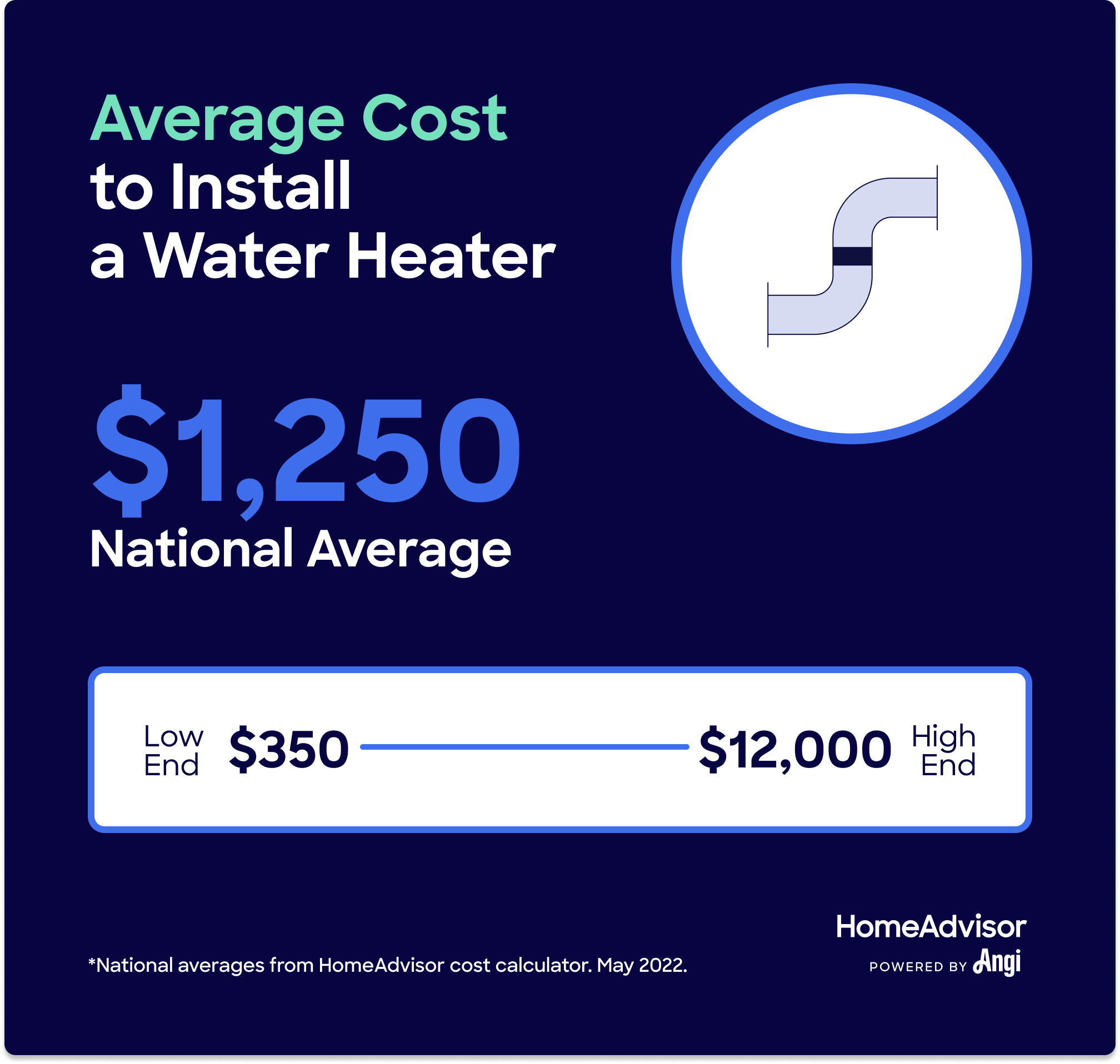

How Much Does Water Heater Replacement Cost

Well do the math for youall you need to do is enter.

. Tax rates range from 025 to 475. Figure out your filing status work out your adjusted gross income Net. The state income tax rate in Oklahoma is progressive and ranges from 025 to 475 while federal income tax rates range from 10 to 37 depending on your income.

Payroll Tax Salary Paycheck Calculator Oklahoma Paycheck Calculator Use ADPs Oklahoma Paycheck Calculator to estimate net or take home pay for either hourly or salaried. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Pay period number begin date.

For example if an employee earns 1500 per week the individuals annual. Oklahoma Oklahoma Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal. No api key found.

Ad Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. Make Your Payroll Effortless and Focus on What really Matters. Important Note on Calculator.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculate your Oklahoma net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Oklahoma. Pay period dates begin on Sunday and end on Saturday.

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Single filers will pay the top. Important Note on Calculator.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Oklahoma. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general.

Ad Compare Prices Find the Best Rates for Payroll Services. The Oklahoma Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Oklahoma. With six marginal tax brackets based upon taxable income payroll taxes in Oklahoma are progressive. Calculating your Oklahoma state income tax is similar to the steps we listed on our Federal paycheck calculator.

Council On Law Enforcement Education And Training Peace Officer Jobs

Oklahoma City Ok Businesses For Sale Bizbuysell

6600 Ne 71st Street Oklahoma City Ok 73141 Zerodown

Net Pay Definition And How To Calculate Business Terms

Pdf The Law Of Diminishing Returns In Clinical Medicine How Much Risk Reduction Is Enough

Creative Director Salary In New York City Ny Comparably

Paycheck Calculator Us Apps On Google Play

Sec Filing Bluelinx Holdings Inc

![]()

How Much To Pay Lawn Care Employees Service Autopilot

40th Annual Meeting Of The Society For Medical Decision Making Montreal Quebec Canada October 13 17 2018 2019

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Oklahoma Salary Calculator 2022 Icalculator

Services Core Group

Paycheck Calculator Take Home Pay Calculator

Average Optometrist Salary Calculator Eyes On Eyecare

How To Calculate A Mortgage Payment On A Regular Calculator Quora

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy